A Major League Baseball (MLB) pension is not a fixed amount but rather a tiered system where the payout depends significantly on a player’s years of credited service in the league. To qualify for a pension, a player generally needs to have at least 43 days of service in a regular season. The actual amount received can range from a few thousand dollars per year for those with minimal service time to well over $200,000 per year for players with extensive careers. This complex structure is a cornerstone of the baseball retirement plan, designed to provide financial security for former players after their playing days are over.

Image Source: bipwealth.com

Fathoming the MLB Pension System

The MLB pension benefits are a crucial aspect of baseball player retirement for those who have dedicated years to the sport. It’s a testament to the advancements negotiated by the MLB players union pension fund over decades, ensuring a more stable future for its members compared to earlier eras. Understanding how these benefits are calculated requires delving into the structure established through collective bargaining agreements.

Service Time: The Key Determinant

The most critical factor in determining the amount of an MLB pension is the number of years a player has accumulated sufficient service time. This isn’t simply the number of seasons played, but rather the number of “credited service periods.”

Credited Service Periods Explained

- The 43-Day Rule: Historically, a player needed to be on the active roster for at least 43 days in a regular season to earn a full year of credited service.

- Pro-Rated Service: For players who don’t reach the 43-day mark in a given season, their service time is often pro-rated. This means a portion of a year is credited based on their time on the roster.

- Collective Bargaining Impact: The specifics of credited service have evolved through various collective bargaining agreements. For instance, changes have been made regarding how players on the injured list or in minor league rehabilitation assignments are credited.

Pension Tiers and Payouts

The MLB pension system is structured into different tiers, each corresponding to a certain number of credited service years. These tiers dictate the annual pension amount a player receives.

Tiered Benefit Structure

- Minimum Service: Players with the minimum required service time (typically 43 days) receive a base pension amount. This is often referred to as the “entry-level” pension.

- Increasing Benefits: As a player accumulates more credited service years, they move up through higher pension tiers. Each subsequent tier offers a higher annual payout.

- Maximum Benefits: Players with exceptionally long careers (e.g., 10 or more credited service years) can qualify for the highest pension tiers, providing substantial annual income in retirement.

It’s important to note that these figures are subject to change based on new collective bargaining agreements. The MLB players union pension constantly negotiates to improve these benefits for its members.

Factors Influencing Pension Amounts

Beyond credited service time, other factors can subtly influence the overall retirement picture for a former player, even if they don’t directly alter the pension calculation itself.

Beyond Credited Service

- Player Contracts and Earnings: While not directly part of the pension calculation, a player’s Major League Baseball player salary and overall baseball player earnings during their active career significantly impact their financial well-being in retirement. High MLB player compensation allows players to save and invest independently, supplementing their pension.

- Annuity Options: Some players may opt for MLB annuity plans, which are separate financial instruments that can provide additional income streams in retirement. These are often purchased with a portion of their career earnings.

- Deferred Compensation: Certain MLB player contracts may include deferred compensation clauses, where a portion of a player’s salary is paid out in later years, sometimes providing a lump sum or annuity-like payments in retirement.

How is the Pension Fund Managed?

The management of the MLB pension fund is a critical process ensuring the long-term financial health of the retirement benefits for players. It involves significant oversight and strategic investment.

The Role of the Players Union and Management Council

The pension fund is typically overseen by a joint committee comprising representatives from both the Major League Baseball Players Association and MLB management. This ensures that the interests of both parties are considered in fund management.

Joint Oversight

- Negotiated Agreements: The framework for the pension fund and its benefits is established through collective bargaining. This means the MLB players union pension representatives play a vital role in negotiating the terms and ensuring fairness.

- Investment Strategies: The committee, often working with professional investment managers, decides on the investment strategies for the pension fund’s assets. The goal is to generate returns that can sustain and grow the pension payouts over time.

Investment Philosophy

The investment strategy for a pension fund of this magnitude is typically conservative yet growth-oriented, aiming to balance risk and reward to meet long-term obligations.

Investment Approaches

- Diversification: The fund’s assets are diversified across various asset classes, including stocks, bonds, real estate, and alternative investments. This diversification helps mitigate risk.

- Long-Term Growth: The primary objective is long-term capital appreciation to ensure the fund can meet its future pension payment obligations.

- Actuarial Soundness: Regular actuarial valuations are conducted to ensure the fund remains financially sound and has sufficient assets to cover projected future pension payments.

Other Benefits for Baseball Retirees

While the pension is a significant component of baseball player retirement, former MLB players often have access to other valuable benefits, particularly concerning healthcare.

MLB Retiree Health Benefits

The MLB retiree health benefits are a crucial aspect of the overall retirement package for many players. These benefits provide coverage for medical expenses in retirement, which can be substantial.

Healthcare Coverage Details

- Eligibility: Eligibility for retiree health benefits typically depends on a player’s years of credited service. Similar to the pension, more service time generally leads to more comprehensive health coverage.

- Coverage Scope: These benefits can include medical, dental, and vision coverage, often with options for different levels of plans.

- Dependents: In many cases, retiree health benefits can be extended to cover a player’s spouse and dependents, offering a significant financial advantage.

Other Potential Benefits

Depending on specific agreements and the player’s career length, other benefits might be available.

Supplemental Benefits

- 401(k) Plans: Many players also participate in 401(k) plans offered through the league or their individual teams, contributing to their retirement savings beyond the pension.

- Union Support Programs: The MLB Players Association often provides various support programs and resources for former players, which can include financial planning assistance or networking opportunities.

Estimating Potential Pension Payouts

Providing exact figures for MLB pensions is challenging because the system is dynamic and dependent on individual service time and negotiated changes. However, we can illustrate potential scenarios based on historical data and general structures.

Illustrative Pension Scenarios

Let’s consider hypothetical scenarios for players with different lengths of service. These are approximations and actual amounts may vary.

Scenario 1: Short Career (e.g., 2-3 Credited Service Years)

- Years of Service: 2-3

- Estimated Annual Pension: This might fall into a lower tier, potentially providing a few thousand dollars per year.

- Focus: At this level, the pension is a modest supplement, and players would heavily rely on other savings and earnings.

Scenario 2: Moderate Career (e.g., 5-7 Credited Service Years)

- Years of Service: 5-7

- Estimated Annual Pension: Players in this category would likely qualify for mid-tier benefits, potentially ranging from $20,000 to $50,000 per year.

- Focus: This provides a more substantial income stream, significantly aiding in retirement security.

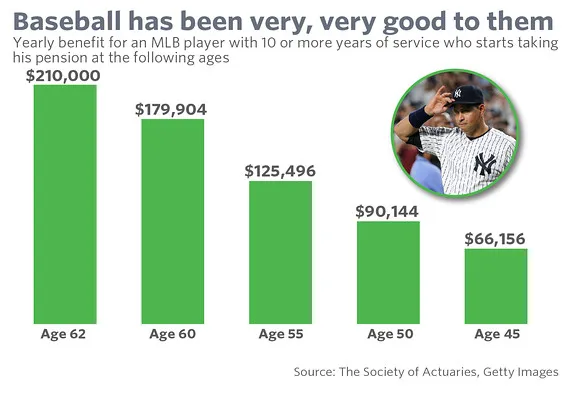

Scenario 3: Long Career (e.g., 10+ Credited Service Years)

- Years of Service: 10+

- Estimated Annual Pension: Players with extensive careers can reach the highest pension tiers, with annual payouts potentially exceeding $200,000 or more.

- Focus: This level of pension can provide a very comfortable retirement, often allowing players to live entirely off their pension and other retirement savings without needing to work.

Table: Estimated Annual Pension Payouts (Hypothetical)

| Credited Service Years | Estimated Annual Pension (Approximate USD) |

|---|---|

| 1-3 | $5,000 – $15,000 |

| 4-6 | $20,000 – $35,000 |

| 7-9 | $40,000 – $70,000 |

| 10-12 | $80,000 – $120,000 |

| 13+ | $150,000+ |

Note: These figures are illustrative and based on general understanding. Actual amounts are determined by the specific collective bargaining agreement in effect at the time of retirement and the player’s exact credited service. They do not account for any potential survivor benefits or other elected options.

The Impact of Career Length on Total Retirement Income

It’s crucial to reiterate that while the pension is significant, it’s often just one piece of the financial puzzle for former MLB players. The disparity in Major League Baseball player salary between a star player and a role player, even with similar service time, can lead to vastly different retirement financial pictures.

Beyond the Pension

- Personal Investments: Players with higher baseball player earnings have a greater capacity to save and invest in personal portfolios, real estate, or businesses, creating additional income streams.

- Deferred Contracts: As mentioned, some MLB player contracts include deferred compensation that can pay out during retirement, acting like a structured annuity.

- Endorsements and Post-Playing Careers: Many players leverage their fame and experience for endorsements, broadcasting roles, or business ventures, further bolstering their financial standing in retirement.

Historical Evolution of MLB Pensions

The MLB pension system has undergone significant evolution since its inception, reflecting the changing landscape of professional sports and the increasing power of player unions.

Early Days vs. Modern Era

In the early days of professional baseball, retirement benefits for players were virtually nonexistent. Players often retired with little financial security, relying on savings or returning to non-baseball jobs.

The Rise of Player Power

- Marvin Miller and the Players Union: The formation and growth of the MLB Players Association, particularly under the leadership of Marvin Miller in the late 1960s and 1970s, was instrumental in establishing and improving player benefits, including pensions.

- Collective Bargaining Milestones: Each collective bargaining agreement has brought about improvements, increasing benefit levels, expanding eligibility, and enhancing retiree health coverage. The pension fund has grown substantially through these negotiated advancements.

The Pension Plan as a Union Success

The MLB pension plan is often cited as one of the most successful outcomes of union advocacy in professional sports. It provides a robust safety net that was unimaginable for players just a few generations ago.

Key Achievements

- Guaranteed Retirement Income: The pension provides a guaranteed annual income, offering a level of financial security that many other professions do not.

- Comprehensive Health Coverage: The retiree health benefits are equally vital, addressing the often-high costs of healthcare for individuals and families in their later years.

- Growing Payouts: The continuous negotiation and growth of the fund mean that pension amounts have generally increased over time, benefiting all eligible retirees.

Frequently Asked Questions (FAQ)

Q1: What is the minimum service time required to receive an MLB pension?

A1: Generally, a player needs at least 43 days of service in a regular season to earn a credited service year towards their pension. Some players may receive pro-rated credit for less than 43 days.

Q2: How much can a former MLB player expect to receive annually from their pension?

A2: The annual pension amount varies significantly based on credited service years. Players with minimal service may receive a few thousand dollars, while those with 10 or more credited years can receive upwards of $200,000 annually.

Q3: Are MLB pensions inflation-adjusted?

A3: Pension plans may include cost-of-living adjustments (COLAs) or other provisions to help maintain purchasing power over time. The specifics depend on the terms of the collective bargaining agreement under which the player earned their service time.

Q4: Does the MLB pension cover lifetime healthcare costs?

A4: MLB retiree health benefits provide coverage for medical expenses after a player retires, but the extent and duration of this coverage are dependent on credited service years and the terms of the specific plan. It’s not a blanket lifetime guarantee for all costs without any conditions.

Q5: Can a player receive their pension as a lump sum?

A5: Typically, MLB pensions are paid out as a regular annuity (monthly or annually). While some retirement plans offer lump-sum options, the standard MLB pension is structured as a stream of income. Some MLB annuity options outside the primary pension might be available for personal savings.

Q6: What happens to the pension if a player passes away?

A6: Pension plans usually offer survivor benefits, allowing a portion of the pension to be paid to a surviving spouse or beneficiary. Players often have options to choose different payout structures that include survivor benefits, which may result in a slightly lower monthly payment during their lifetime.

Q7: How does a player’s salary impact their pension?

A7: A player’s Major League Baseball player salary does not directly increase their pension amount. The pension is solely based on credited service years. However, higher baseball player earnings allow players to save more independently, contributing to their overall retirement financial security alongside the pension.

Q8: Who manages the MLB pension fund?

A8: The MLB pension fund is managed by a joint committee consisting of representatives from Major League Baseball and the Major League Baseball Players Association, often with the assistance of professional investment managers.

Q9: What is an MLB annuity in the context of retirement?

A9: An MLB annuity typically refers to a personal retirement savings plan, often a 401(k) or similar investment vehicle, that a player contributes to from their baseball player earnings or MLB player compensation. This is separate from the mandatory pension fund but contributes to their overall retirement income.

Q10: How much did players earn in the past compared to today?

A10: Major League Baseball player salary has dramatically increased over the decades. While early players earned modest wages, today’s players can command multi-million dollar annual salaries, leading to significantly higher potential personal savings to supplement their pensions. This contrast highlights the importance of the pension system for players from earlier eras.